2022 Bonus Depreciation Vehicle List

2022 Bonus Depreciation Vehicle List

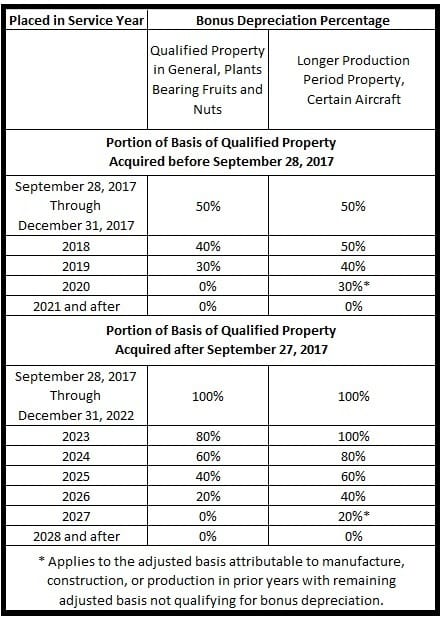

It was scheduled to go down to 40 in 2018 and 30 in 2019 and then not be available in 2020 and beyond. 1 2018 remains at 50 percent. If the taxpayer doesnt claim bonus depreciation the. Delivery type vehicles like a classic cargo van or box truck with no.

6 000 Pound Vehicle List Special Irs Depreciation Tax Benefit Diminished Value Of Georgia

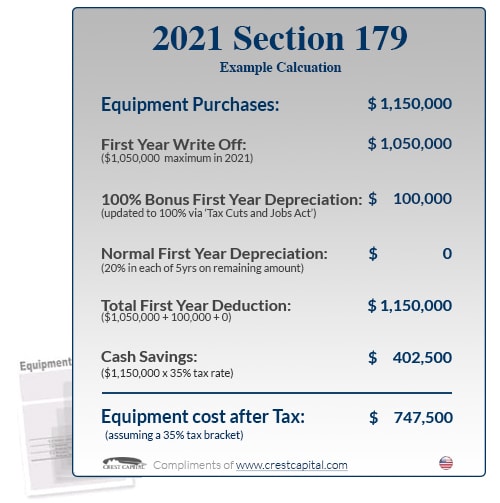

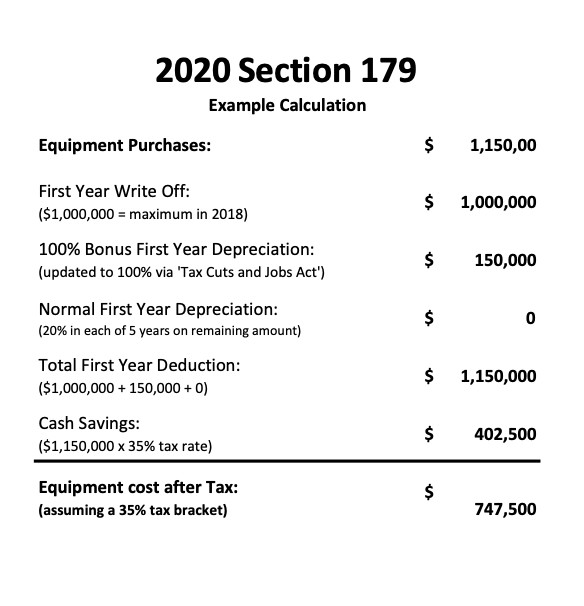

New and pre-owned heavy SUVs pickups and vans acquired and put to business use in 2021 are eligible for 100 first-year bonus depreciation.

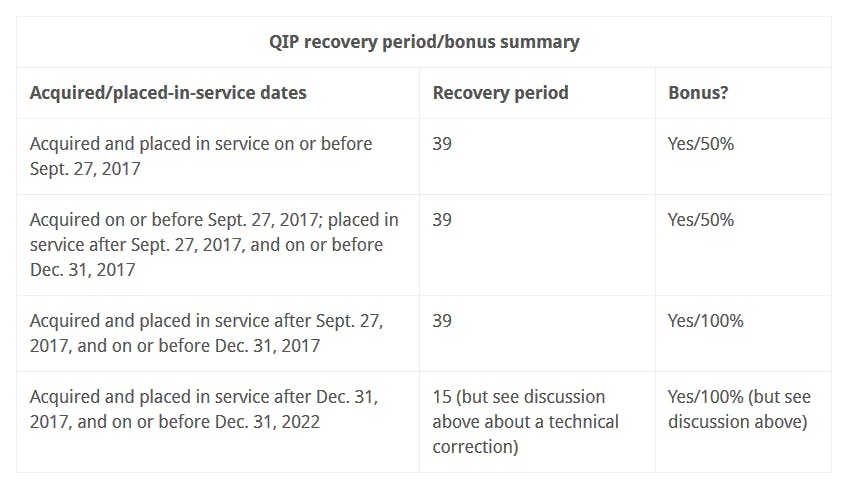

2022 Bonus Depreciation Vehicle List. Special rules apply for longer production period property and certain aircraft. 2021-31 the updated limits which apply to vehicles far below the Rolls-Royce levelThere are different tables. WASHINGTON The Treasury Department and the Internal Revenue Service today released the last set of final regulations implementing the 100 additional first year depreciation deduction that allows businesses to write off the cost of most.

Obvious work vehicles that have no potential for personal use typically qualify. Aug 09 2021 By Bailey Finney The tax law has special depreciation limits for motor vehicles - often incongrously called the luxury auto rulesThe IRS has released Rev. IR-2020-216 September 21 2020.

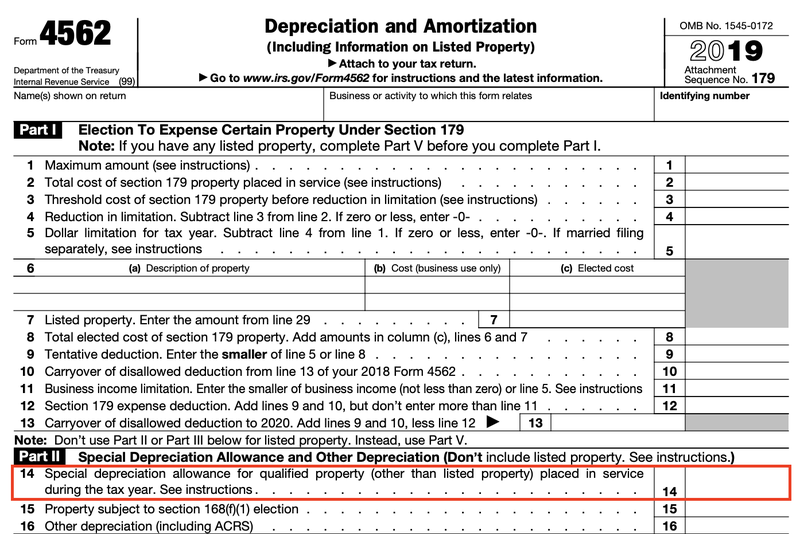

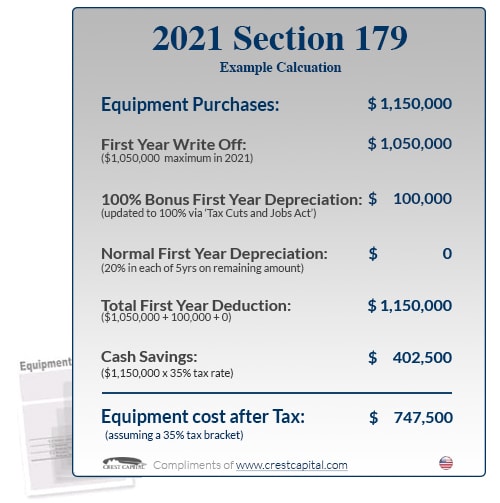

Thanks to the Tax Cuts and Jobs Act of 2017 TCJA a business can now write off up to 100 of the cost of eligible property purchased after September 27 2017 and before January 1 2023 up from 50 under the prior law. Motor buses motor lorries motor cars and motor taxies used in a business of running them on hire. It allows a business to write off more of the cost of an asset in the year the company starts using it.

The Ultimate Fleet Tax Guide Section 179 Gps Trackit

2020 Section 179 Commercial Vehicle Tax Deduction

What Is Bonus Depreciation A Small Business Guide The Blueprint

2020 Tax Code 179 For Business Owners The Self Employed

Section 179 Tax Deductions2 Bell Ford

Publication 946 2020 How To Depreciate Property Internal Revenue Service

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

Bonus Depreciation A Simple Guide For Businesses Bench Accounting

Bonus Depreciation Rules Recovery Periods For Real Property And Expanded Section 179 Expensing Baker Tilly

Depreciation Challenges For Flip Flop Bonus Conformity States Bloomberg Tax Accounting

Bonus Depreciation And Sec 179 Expense What S The Difference Bmf

Income Tax Benefits Available To Salaried Persons For A Y 2022 23

Bonus Depreciation Haynie Company

The Ultimate Fleet Tax Guide Section 179 Gps Trackit

Bonus Depreciation For Your Business Let S Review Your Options

Depreciation Guidelines For Vehicles And When To Report Them As Listed Property

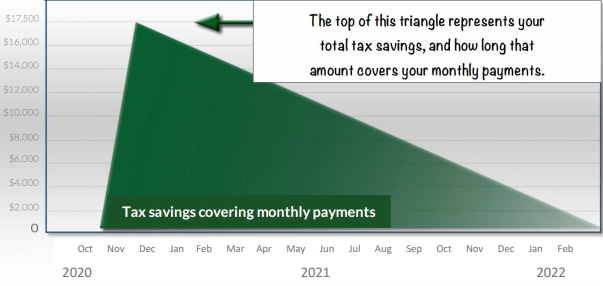

The Case For Bonus Depreciation

Section 179 And Bonus Depreciation In 2013 Blackburn Childers Steagall Cpas

Post a Comment for "2022 Bonus Depreciation Vehicle List"